Since 2019, households have weathered an extraordinary series of shocks: the COVID-19 pandemic, a cost-of-living crunch, rising mortgage rates, visible strains in public services, and unprecedented uncertainty due to global conflict. Any one of these might have been expected to alter consumption patterns materially.

Yet when we step back and examine the data, a striking picture of stability emerges. In aggregate, consumer spending in the UK—both overall and by category—looks surprisingly like the pre-volatility baseline.

The surprise of stability

Despite predictions of a reset, overall inflation-adjusted consumption volumes in 2024 were only marginally above 2019 levels, posting an annual increase of just 0.2% over five years. With population growth at 0.8% per annum, real consumption per capita in fact declined slightly, by 0.6% per year.

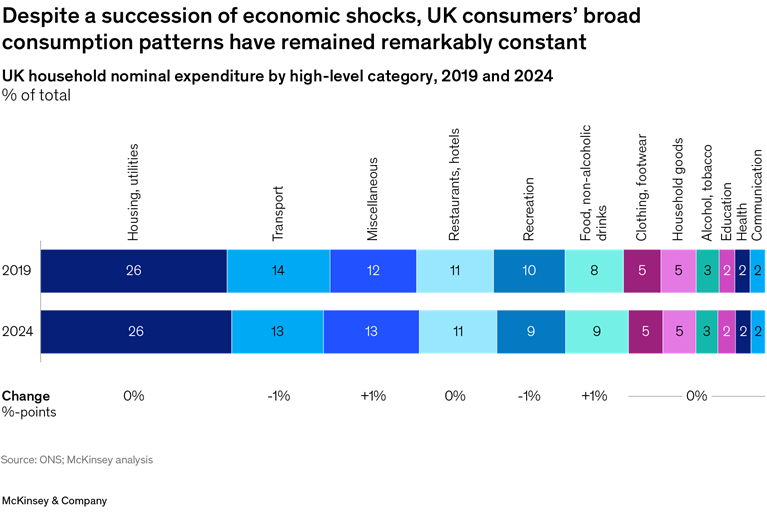

Even more surprising is how little the composition of household spending has evolved. Despite large movements in relative prices—from a 31% rise in food and non-alcoholic drink prices to a 12% fall in phone equipment and services—the share of spending on major categories like housing, transport, hospitality, and food has remained remarkably stable.

In other words, this isn’t a story of dramatic shifts—it’s one of quiet resilience. Consumers have adjusted at the margins but retained the underlying shape of their consumption even as conditions have shifted around them.

The one big shift: home comforts

The one significant change in many people’s circumstances is the increase in hybrid working. In 2019, around 12% of workers said they had worked from home at some point in the previous week. In April 2025, that figure stood at 41% – a more than three-fold increase. Two thirds of these people said they were working a hybrid pattern, spending some of their time at home and some of it at their place of work.

So, does this shift show up in consumption patterns? No and yes. The demand for items typically used at home—such as groceries, homewares, and appliances—rose by less than 2% between 2019 and 2024. On a per capita basis, this represents a fall in the volume of purchases of around 2%. Either way, overall home-based consumption changed relatively little, despite people spending more time at home.

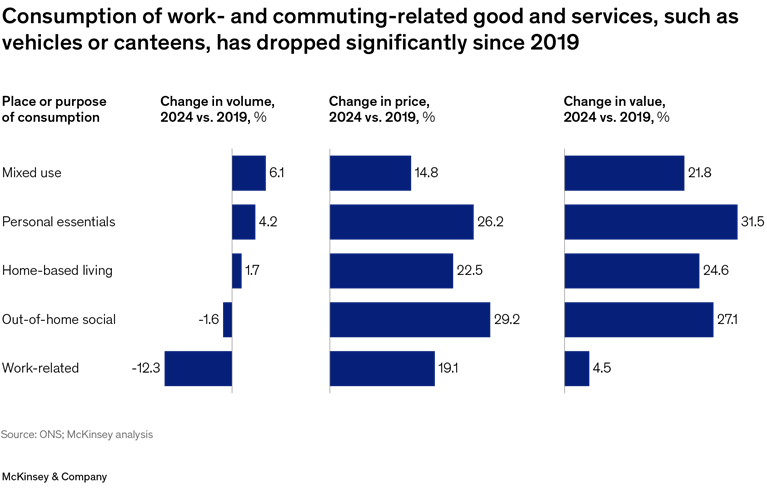

What stands out much more is the decline in work-related consumption. Even with below-average price increases, the volume of these purchases fell by 12% overall (Exhibit 2), with especially steep drops for canteens (-38%) and commuting-related items, such as cars (-21%), vehicle maintenance and repair (-21%), and rail transport (-9%).

The relatively flat trend in home-based consumption from 2019 to 2024 masks a more nuanced story—one that sheds light on the so-called “nesting” phenomenon. During the lockdowns of 2020 and 2021, many consumers, confined to their homes, redirected spending toward enhancing their living spaces: investing in furniture, home tech, kitchen equipment, and other upgrades that made their environment more multifunctional. In some categories elevated spending levels have persisted into 2024. In others, pandemic-era front-loading has led to a natural dip in subsequent years.

Where demand has held up, it has done so in spite of rising prices. Between 2019 and 2024, purchases of milk, cheese, and eggs rose by 8%, even as prices climbed nearly 40%. Inflation-adjusted expenditure on pets and related products rose by 14%, and by 27% for veterinary services, even though prices for both outpaced general inflation by a wide margin. Similar patterns can be seen in tools, major appliances, and everyday comforts like wine (off-trade), coffee, and tea.

These gains, however, have been counterbalanced by declines elsewhere. Consumption of electricity and gas has declined—likely due to a mix of cost-conscious behaviour and improved efficiency. Categories that saw a pandemic-driven spike, such as furniture and furnishings, household textiles, and small electric appliances, are now experiencing reduced demand as households have yet to see the need to replace earlier purchases. Meanwhile, long-standing downward trends continued in areas like books.

Enticing the cautious consumer

UK consumers’ purchase patterns have proved quite stable. But that doesn’t mean they feel secure. McKinsey’s quarterly ConsumerWise research has been tracking the growing gap between spending (fairly stable) and sentiment (sharply negative). Consumers are not as predictable as they used to be.

The UK consumer is especially cautious. The household savings ratio remains elevated at 12% and trading down is widespread—even among higher-income households. While some UK consumers – about one third – are still willing to splurge, the majority are making selective, deliberate trade-offs: swapping work-related costs for home comforts, postponing big-ticket purchases, and looking for everyday value.

Furthermore, we see that the pandemic spurred some sticky shifts in how consumers spend their time, and choose to shop. McKinsey’s State of the Consumer 2025 research shows that Western consumers are spending more time at home, and more time engaged in solo leisure. Consumers reported three hours more free time in 2024 versus 2019. That’s the good news. The bad news is 90% of it was spent alone. They also report greater use of digital platforms, and greater use of delivery.

For businesses, the task is to meet this consumer on their terms. That means offering value that’s not just price-based, but rooted in relevance, quality, and emotional payoff. It means meeting the consumer in the channels they want to shop in, particularly digital. And it means spotting the quiet behavioural pivots that don’t show up in top-line growth but reveal themselves where demand is reconfiguring beneath the surface.

The big behavioural reset may never have materialised—but the smaller rewirings are real, and they matter. Businesses that succeed won’t be those that bet on broad-based change. They’ll be the ones that entice the cautious consumer—by tuning into what’s sticky, what’s shifting, and what still matters.