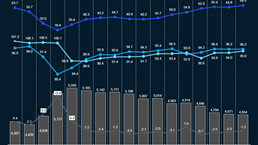

Brent crude oil prices decreased in May to an average of USD64.5/bbl m-o-m, a decline of USD3.7/bbl compared to the previous month’s average. Oil prices in May 2025 were at their lowest point since May 2021, amid escalating US tariffs and larger-than-expected OPEC+ output hikes, which has eroded the fuel demand outlook:

- Global oil demand. Global liquids demand increased marginally in May by 0.3 MMb/d m-o-m to 102.6 MMb/d. The minor increase in demand from the Middle East and India was offset by similar levels of demand decline in Japan and the United States

- OPEC 9 production (excl. Iran, Venezuela, Libya). OPEC 9’s production remained relatively stable, witnessing a marginal increase of ~0.3 MMb/d to 27.4 MMb/d in May, with no single country contributing to significant change. Eight OPEC+ members have agreed to speed up their production output hike, planning to increase cumulative volumes by ~0.4 MMb/d again during June

- Non-OPEC production (excl. US shale). Non-OPEC production witnessed a slight decline of 0.3 MMb/d m-o-m averaging at 62.1 MMb/d in May. Production declines where majorly noticed in Brazil, Canada, Kazakhstan, and China

- US shale oil production. US shale production levels remained virtually the same m-o-m, averaging at 9.2 MMb/d in May. The number of active rigs stood at 553 during May, down by twelve units compared to April 2025

- Iran, Venezuela, Libya production. Combined production levels in Iran, Venezuela, and Libya averaged at 5.6 MMb/d during May 2025, with none of the countries showing a significant change in volumes

- Commercial inventories.1 Global commercial inventories increased by ~97 million barrels in May, mainly driven by an increase in non-OECD inventories. Overall, inventories have remained relatively steady at ~4.5 billion barrels over the last six months

- Market sentiment. Amid a weaker global economic outlook and declining oil demand, OPEC+ announced a second consecutive monthly production increase of ~0.4 MMb/d for June. This decision came despite falling benchmark crude oil prices in April and May, driven by escalating US tariffs and larger-than-expected OPEC+ output hikes. Concurrently, stricter enforcement of sanctions on Venezuela, Iran, and Russia may counterbalance some of the production increases

1 Non-OECD share of inventories is estimated, assuming that non-OECD inventories have 50% days of demand cover of OECD inventories

Download dashboard:

Oil supply & demand dashboard: May 2025

Subscribe to Energy Solutions

To receive our oil supply & demand dashboards, please subscribe to upstream oil and gas updates from Energy Solutions.